Filing for a tax refund can be a common process for Irish taxpayers who overpay tax or qualify for various tax credits and reliefs. But how long does it take for your refund to reach you? Understanding the timelines and factors that influence the refund process helps in setting realistic expectations. This blog has been specially crafted for all those taxpayers who want to learn more about tax refunds and tax refunds processing time in Ireland. We at TaxRebates.ie urge you to file for tax rebates! Why leave your hard earned money on the table?

How Tax Refunds Work in Ireland?

When you submit a claim for a tax refund through Revenue’s myAccount or via paper forms, the refund timing can vary based on several factors such as the completeness of your documentation and whether additional verification by Revenue is needed. Filing online is typically faster, with processing timelines usually ranging from a few days to about five weeks for more complex cases.

Who Can Claim a Tax Refund?

Tax refunds are typically available to:

- PAYE (Pay As You Earn) Employees: If you are employed and paying tax through PAYE, you may have overpaid due to changes in circumstances, unused credits, or missed reliefs.

- Self-Employed Individuals: As part of the self-assessment process, self-employed people may also be entitled to refunds if they have overpaid.

- Students: Those who worked during summer months and overpaid tax are often entitled to refunds.

- Retired Individuals: In cases where pensions are taxed but overall income is below the taxable threshold, refunds may be applicable.

Common Reasons for Tax Refunds

You may be entitled to a refund due to:

- Medical and Dental Expenses: Certain expenses can be claimed back as tax relief. Medical expenses must be unclaimed by insurance to qualify.

- Flat-Rate Expenses: These are expenses incurred as part of your employment and cover a wide range of professions.

- Tuition Fees: Relief may be available on qualifying tuition fees for approved courses.

- Marriage or Civil Partnership Tax Credits: If your status changed and you were not benefiting from the appropriate tax bands or credits, you could be due a refund.

- Unclaimed Tax Credits: For example, home carer tax credit, dependent relative tax credit, etc.

- Work-Related Expenses: Such as professional subscriptions or union fees.

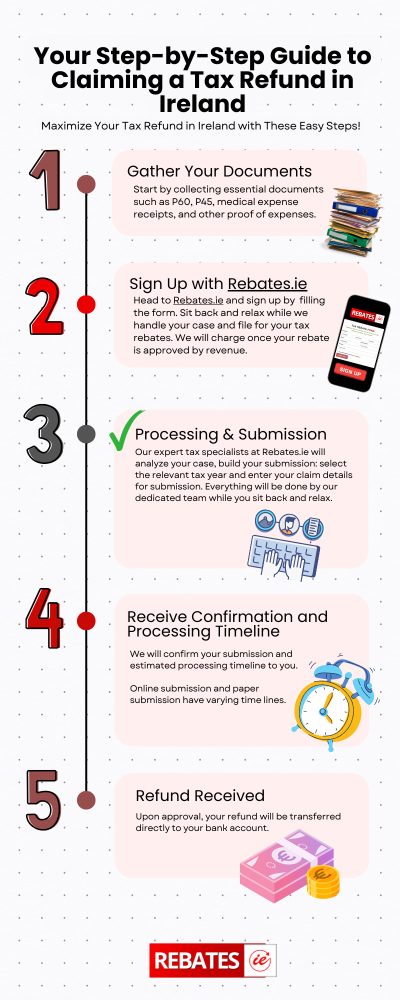

Tax Rebates Process

How Long Does It Take to Get a Tax Refund in Ireland?

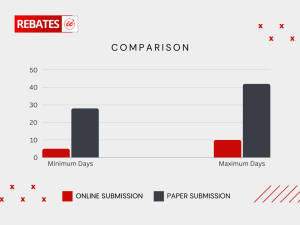

Average Refund Timelines

- Online Submissions: Usually processed within 5 to 10 working days.

- Paper-Based Submissions: May take longer, averaging four to six weeks for processing.

- Self-Assessed Filers: Self-employed individuals or those under self-assessment filing their Form 11 can generally expect to receive refunds within a similar time frame once their tax returns are processed, provided there are no outstanding issues.

Factors Influencing Delays

- Verification Requirements: Additional checks on submitted claims for unusual credits or reliefs.

- Accuracy of Submitted Information: Errors in forms can lead to delays.

- High Volume Periods: Peak seasons such as just before the Pay and File deadline can slow down processing times.

Case Study: Speedy Refund Processing via Rebates.ie

John, an IT professional in Dublin, overpaid tax in 2023. We filed for his tax rebates via online submission, on January 15th 2024. The claim was for a refund of medical expenses. Within a week, he received a notification that his refund was approved, and within 10 working days, the funds were deposited into his bank account.

To ensure you receive your refund as quickly as possible, double-check your submissions for accuracy and use the online system when possible. If you need assistance navigating the tax refund process, Rebates.ie offers expertise to maximize your return without any upfront fees—your rebate is only charged once approved. Claim your tax rebate today!

Case Study: Medical Expense Tax Relief via Rebates.ie

Consider Mary, who had significant medical expenses over the past year totaling €2,000. She wasn’t aware that many of these expenses were eligible for tax relief at the standard rate of 20%. By gathering her receipts and Rebates.ie submit a claim, Mary received a tax refund of €400 (20% of her expenses), directly into her bank account within two weeks.

Don’t let unclaimed refunds slip through your fingers. Whether it’s medical expenses, tuition fees, or other eligible reliefs, Rebates.ie can help ensure you get your maximum refund with zero upfront costs—only charging when your refund is approved. Claim Your Tax Refund Now!