What is a flat-rate expense allowance?

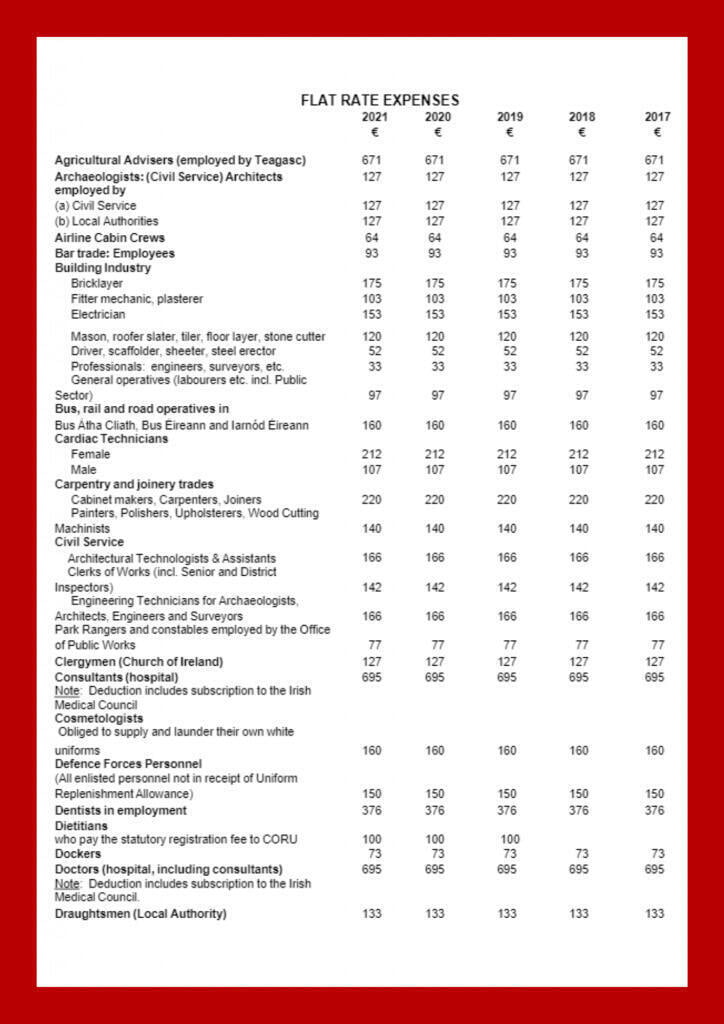

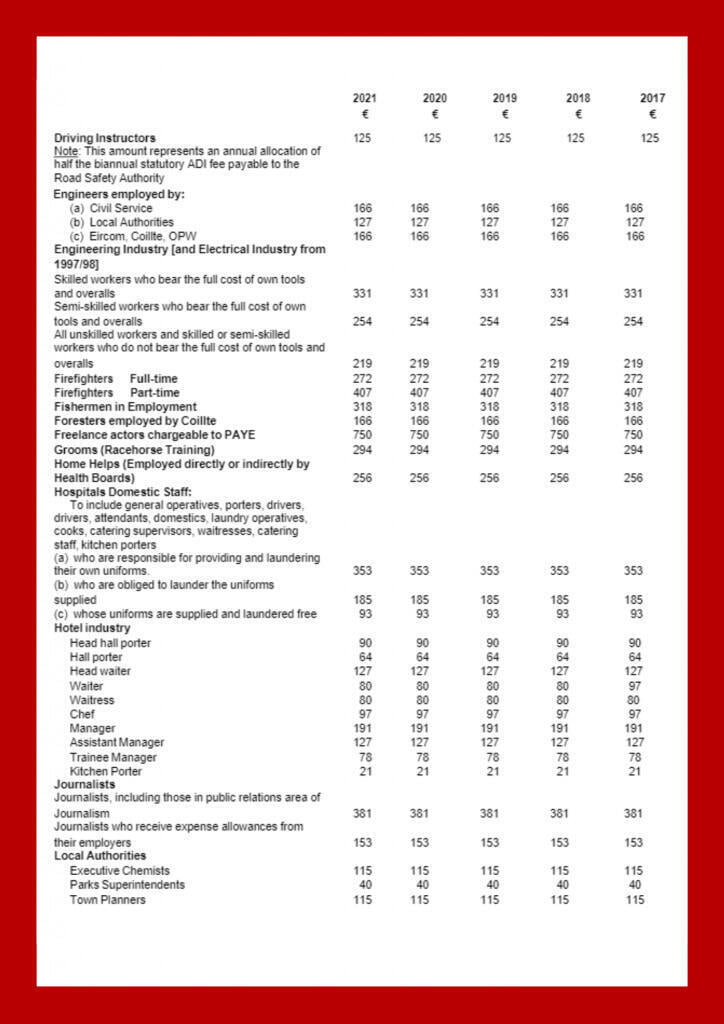

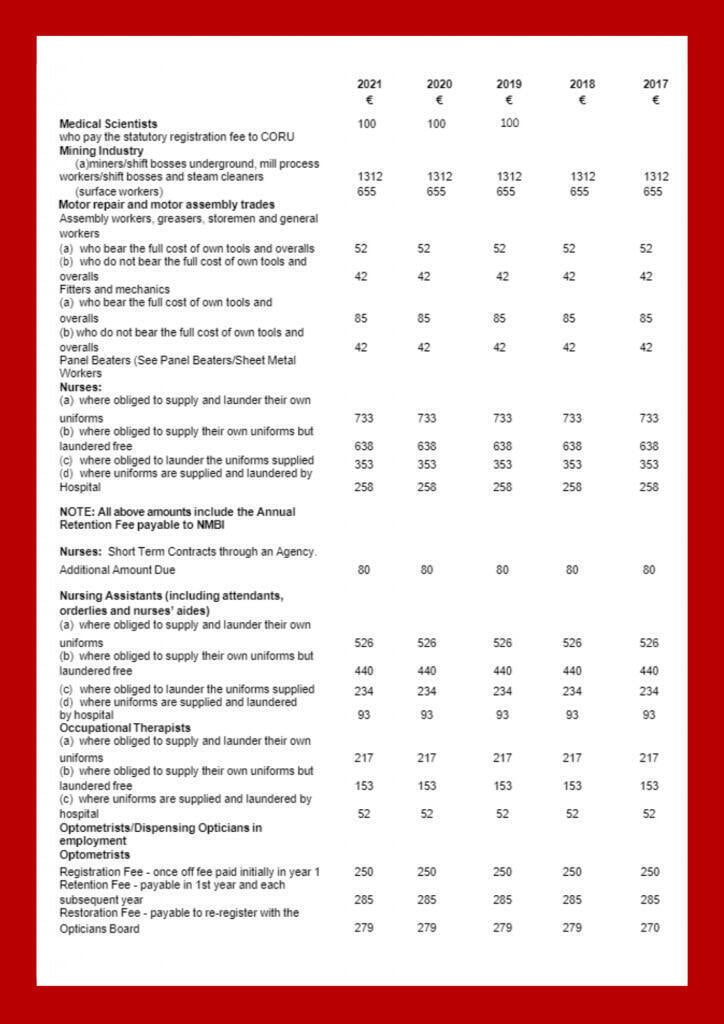

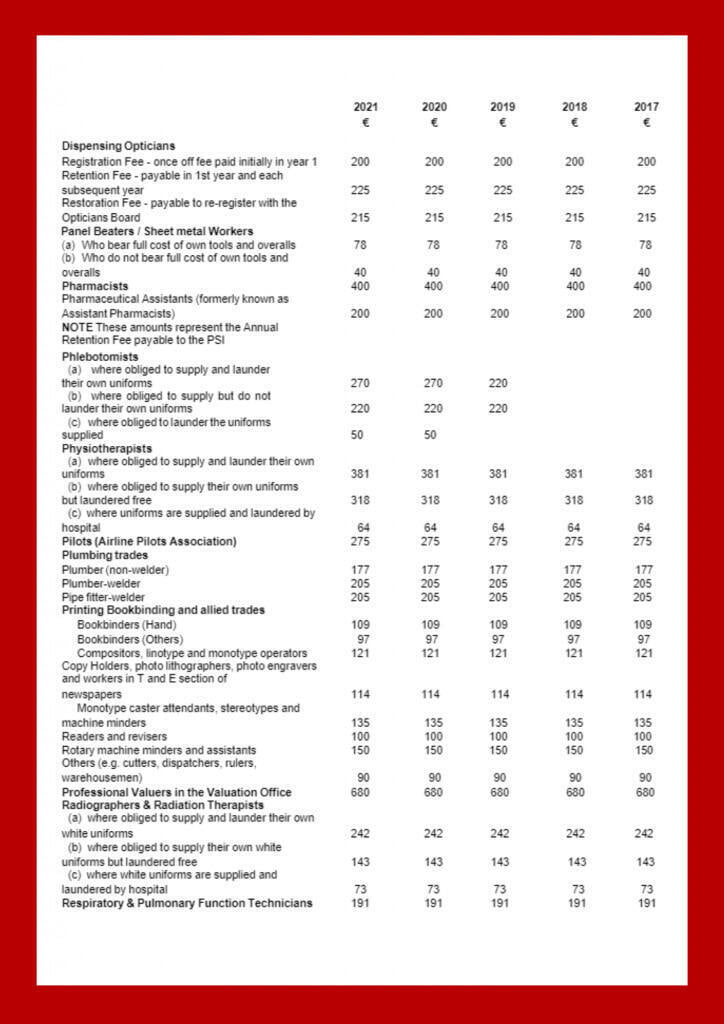

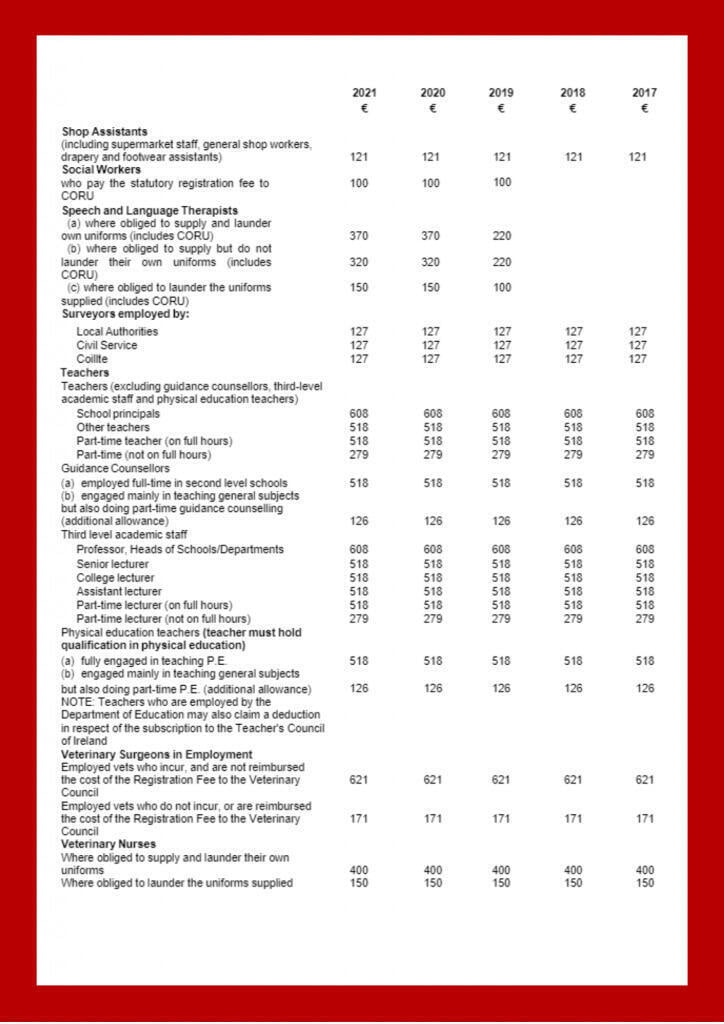

Flat-rate expenses are allowances that are provided to individuals in a selected range of occupations. Flat-rate expenses are for covering the cost of work-related equipment such as tools, uniforms, and stationery. Individuals must incur these costs for performing their job duties, and the costs must be directly related to the nature of their job.

Am I eligible to claim flat-rate expenses?

For example, the flat-rate expenses allowance allocated to a Nurse is €733.

How can I claim flat-rate expenses?

You can receive a flat-rate expense allowance only if you claim it. In some cases where your employer provides this information to the revenue, you will automatically receive this tax credit/relief every year. But, in most cases, you must claim them yourself by completing and submitting a Form 12 to the Revenue.

And, if you have not checked this yet, you might have missed out thousands of euros from the past years. So, we suggest you check this now.

Need help with claiming your flat rate expenses?

At Rebates.ie, we can help you claim your flat-rate expenses and many other expenses.

A member of our team will review your tax records and make sure that you do not miss out on any tax credits or reliefs that you are entitled to.

We review your tax records for the past 4 years and help you claim back any tax credits or reliefs that you are owed.

The best part is that it takes only 1-minute to apply. No Refund, No Fee!

List of Flat rate Expenses